Investment Management and Performance

About the Endowment Portfolios

Whether to set up a fund with HFPG, Inc. or in trust with the Hartford Foundation for Public Giving is at the discretion of the donor. The service provided by the Foundation is the same. Learn more about giving to the Hartford Foundation.

These two entities are included in the Foundation's annual audited financial statements and IRS Form 990.

You can request a copy by contacting the Foundation at 860-548-1888 or hfpg@hfpg.org. Selected consolidated financial information is also shown in the Foundation’s annual report.

Created in 1979 as a nonprofit corporation, HFPG, Inc. serves as a corporate affiliate of the Hartford Foundation. The assets which comprise the donor funds that are held in HFPG, Inc. are held in custody at Northern Trust and are invested with professional investment managers chosen by our Outsoruced Chief Investment Office (OCIO), Cerity Partners, with oversight by the Investment Committee. Cerity Partners serves as the OCIO beginning January 1, 2024. Funds established in HFPG, Inc. are invested on a diversified basis with investment managers selected by Cerity Partners. These managers are chosen based on their specialization in a given asset class after rigorous due diligence to measure key attributes of manager capability and firm stability. Manager performance is monitored regularly by Cerity Partners, and reviewed with the Investment Committee and the Foundation’s Board of Directors on a quarterly basis.

This consists of numerous trusts established by many donors with trustee banks since 1925, each governed by a Declaration of Trust. Today, Bank of America, N.A. acts as the Trustee of these component trusts, which are held in a common fund. Bank of America also serves as the custodian of the trusts held in the Trust portfolio. The Trustee has sole authority to invest in a diversified portfolio with professional investment managers (which may include Bank of America, N.A. or any of its investment management affiliates) chosen on a competitive basis. NEPC, LLC of Boston, Massachusetts, serves as investment consultant to the Trust.

Investment manager selection for the Trust is reviewed with the Foundation’s investment staff and Investment Committee. Investment performance is monitored regularly by the Trustee and the consultant, and reviewed by the Foundation’s Investment Committee and Board of Directors on a quarterly basis.

Investment Philosophy and Managers

We are patient, long-term investors and maintain broad diversification within the investment portfolio. Outside investment professionals manage our endowment and are overseen by the Foundation's Investment Committee. These investment professionals select and monitor investment managers. We seek to retain sophisticated, operationally-sound, institutionally-oriented investment management firms which actively control the growth of their firm’s assets under management. These investment managers should be experienced, focused, disciplined, patient, and consistently able to balance the risk and reward of the securities they purchase and the portfolios they manage. We pay close attention to the management fees we pay for these services.

THE ALLOCATION OF THE ENDOWMENT AMONG AVAILABLE ASSET CLASSES HAS A KEY INFLUENCE ON LONG-TERM INVESTMENT RESULTS.

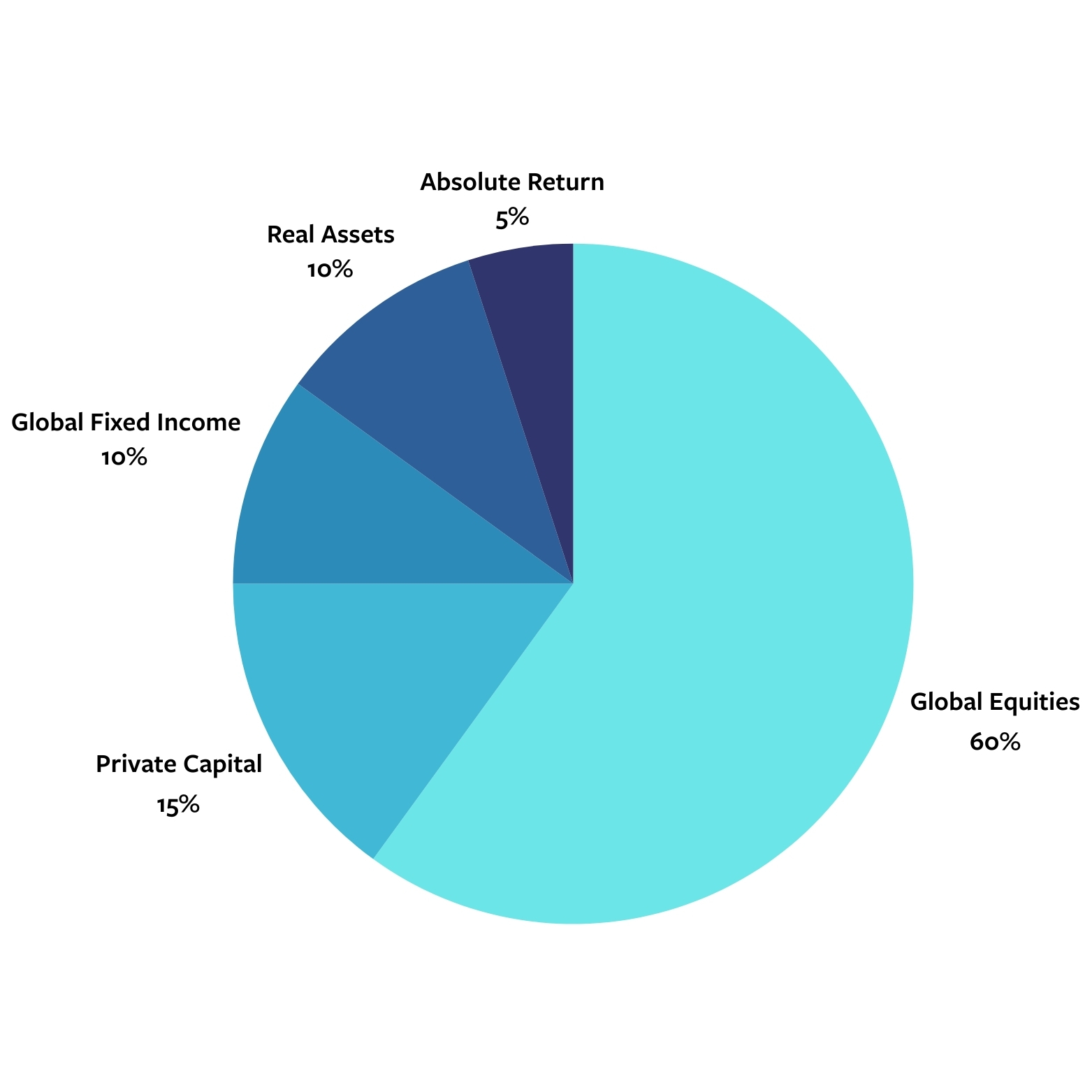

Corporate Portfolio

As of December 31, 2024

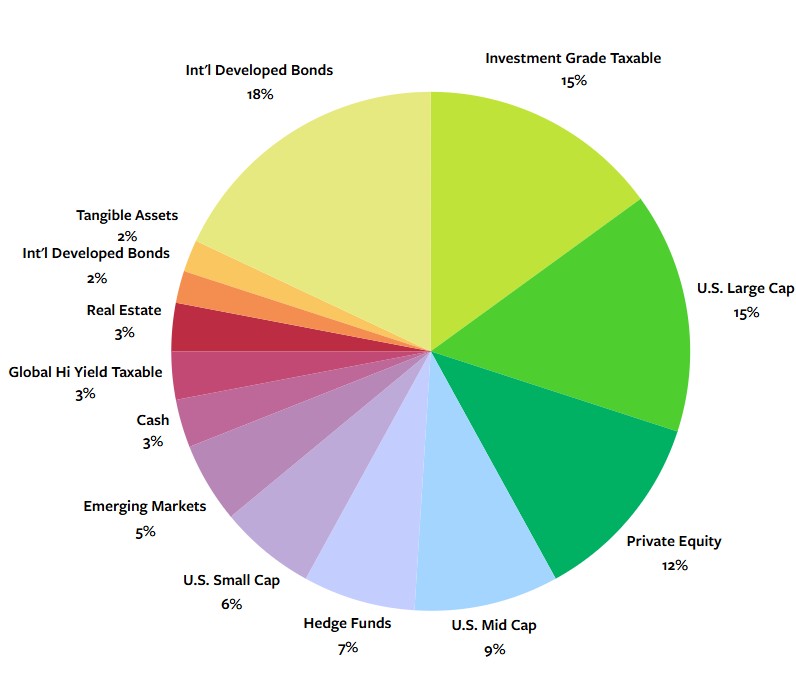

Trust Portfolio

As of December 31, 2024

REBALANCING

The endowment’s asset allocation is reviewed on a continual basis, and portfolio rebalancing to long-term asset allocation targets is conducted when needed.

Investment Performance

The Hartford Foundation’s assets are managed by its corporate affiliate, HFPG, Inc. (the “Corporate Portfolio”) and by the Hartford Foundation Trust (the “Trust Portfolio”).

The investment performance* of the Foundation’s broadly diversified endowment portfolios for periods ended December 31, 2024 is as follows:

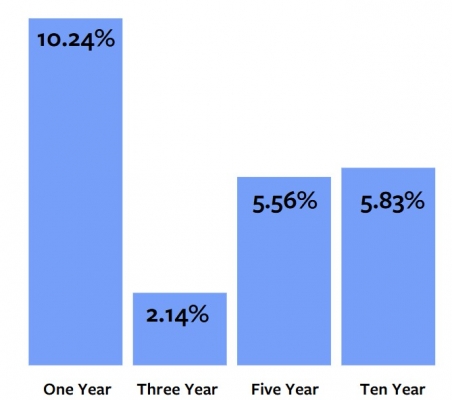

CORPORATE PORTFOLIO

(HFPG, Inc.)

$547.8 MM**

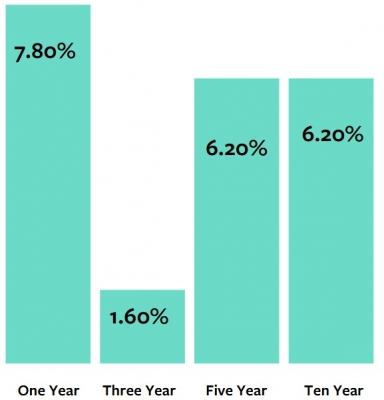

TRUST PORTFOLIO

(Trustee Bank)

$626.9 MM**

*These annualized investment returns are net of investment management fees.

**Rounded to the nearest $100,000. Past performance is no guarantee of future results.

HOW HAVE THE HARTFORD FOUNDATION'S INVESTMENTS PERFORMED?

2024 was a solid year for economic growth, both globally and within the U.S. economy. U.S. equity markets saw notable gains, with the S&P 500 climbing 23.95% and the Dow Jones Industrial Average increasing by 13.25%. On the global front, equity markets, as tracked by the MSCI All Country World Index, grew by 17.5%. Inflation continued its downward trend, rising by 2.9% for the year. Meanwhile, the bond markets remained relatively subdued in response to changes in Federal Reserve policy, resulting in a 0.75 basis point reduction in the federal funds rate in 2024.

Against this backdrop, the Corporate Portfolio rose 10.2%, an outcome that was 210 basis points below the benchmark. The Trust Portfolio returned a positive 7.8%, 140 basis points below the benchmark. Our diversified portfolios remain well positioned across a variety of asset classes, investment managers and geographies.

When reviewing these returns, please note that past performance is not a guarantee of future results.

Last updated December 31, 2024

Annual Audits

The Foundation’s Form 990 and past financial statements are available for public review.